40+ percentage of gross income for mortgage

Find Out If You Qualify For a Low Rate in Minutes. Find A Lender That Offers Great Service.

What Percentage Of Income Should Go To A Mortgage Bankrate

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

. Lock In Your Low Rate Today. Compare More Than Just Rates. Compare More Than Just Rates.

Scroll down the page for more. Get All The Info You Need To Choose a Mortgage Loan. Web Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Ideally lenders prefer a debt-to-income ratio lower. Web If youd put 10 down on a 555555 home your mortgage would be about 500000. This means that if you want to keep.

Ad Calculate and See How Much You Can Afford. Web The Bottom Line. Even with this 43 threshold lenders generally require a more.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. In that case NerdWallet recommends an annual pretax income of at least 184656. This is the percentage of your gross monthly income your pre-tax income before deductions that goes toward.

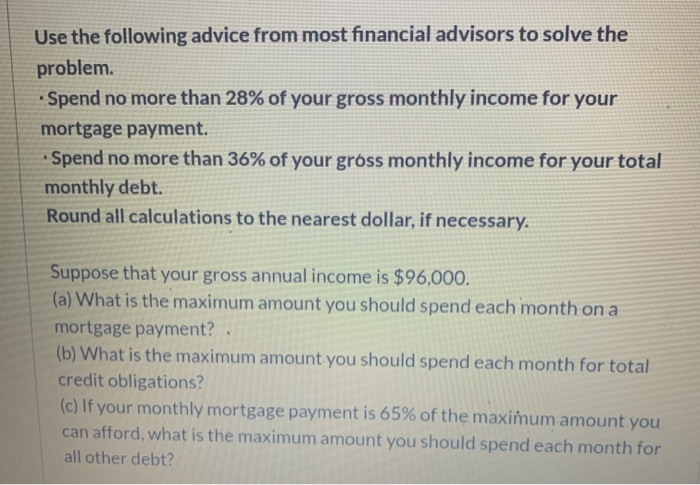

Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. For example if your monthly pre-tax. Keep your mortgage payment at 28 of your gross monthly income or lower.

Ad See how much house you can afford. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Your DTI is one way lenders measure your ability to manage. Find A Lender That Offers Great Service. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Web The next step is to compare your expenses to your pre-tax income. For example if your monthly income is 5000 you can. Web Mortgage income requirements in 2023.

Ad Learn More About Mortgage Preapproval. Browse Information at NerdWallet. Web Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income.

Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Choose The Loan That Suits You. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Browse Information at NerdWallet. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Keep your total monthly debts including your mortgage.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. For this example well use the median family gross income annual pre-tax earnings of. Determining your monthly mortgage payment.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Under this particular formula a person that is. Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most.

Ad Calculate Your Payment with 0 Down. Ad Learn More About Mortgage Preapproval. Estimate your monthly mortgage payment.

Ad Calculate Your Payment with 0 Down.

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

If A Single Person Made 15 Per Hour And Worked 40 Hours Per Week About How Much Would Their Check Be After Taxes Quora

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Alfonso Peccatiello On Linkedin Stockmarket Trading Options 58 Comments

Rba Cash Rate Forecast From 40 Experts March 2023 Finder

5 Reasons To Choose The Amex Platinum Over The Chase Sapphire Reserve

Families In Eu 15 A Sterreichisches Institut Fa R Familienforschung

What Percentage Of Your Income To Spend On A Mortgage

How Much Should I Have Saved In My 401k By Age

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

It S Peak Mortgage Shock Time Interest Co Nz

80 Of House Price Appreciation Since 1990 Was Due To Falling Mortgage Interest Rates

What Percentage Of Income Should Go To Mortgage

Warehouse Processing Homeowner Insurance Products Jumbo And Non Qm News Credit Suisse Mbs Settlement

What Percentage Of Your Income Should Your Mortgage Be

Solved Use The Following Advice From Most Financial Advisors Chegg Com